Last time we saw how Bob Crusoe, shipwrecked on an island, was able to save by producing more than he consumed. This meant he built up a stock of tangible assets which let him carry on consuming later on when he wasn’t able to produce for some reason. Survival would be precarious without some savings.

Because Bob was alone on an island, it didn’t make sense to use money. But it’s not like that for most of us, so in everyday use, saving means keeping some of the money which you receive instead of spending it all.

Is this a completely different idea from what Bob was doing — or could it be that saving just means adding to your raw net worth1?

(TL;DR: Saving does mean adding to your RNW, but beware of insolvency!).

How to save with debt

Imagine some people bring Frank by boat to Bob’s island, intending to kill him2, but Bob rescues him by scaring off the perpetrators, who row away and never return. Now we have a more interesting economy with two people.

Bob and Frank decide it would be best to have different places to live (since they both snore). Frank finds a small cave near to Bob’s, but it doesn’t have any space for storage. This is unlucky for Frank, but lucky for us, because it helps us to understand savings better.

With Frank on the island, they’re going to need twice as much food and fuel each day. As we saw last time, it’s important to save food and fuel for when they can’t produce any for a while. Since only Bob has space for storage, they’re going to have to keep all of their savings in Bob’s cave. But how do they keep track of how much is Bob’s and how much is Frank’s?

One way they could do it is for Bob to “write” Frank an IOU whenever Frank places food or fuel in the cave. They could use a tally stick system where notches are cut3 in a stick to represent how much Bob owes to Frank, and the stick is split in half, so they both have a copy of the information.

When Frank wants to take something from his share of the store, he can tell Bob how much he wants, and hand over his half of a tally stick to prove Bob owes it to him. When Bob checks that it matches his half, he gives Frank what he’s requested, and then breaks the stick because the debt’s no longer owed.

This all works very well. Let’s look at the situation 2 weeks after Frank was rescued. Bob still has 28 days’ food4 and 28 days’ firewood saved, and now Frank, who’s been working hard, has gathered 14 days’ food and 14 days’ firewood more than he’s consumed. How do their individual balance sheets look, and how about their combined balance sheet?

Let’s start with the combined balance sheet.

Between them, they have 42 days’ food and 42 days’ firewood. The debt from Bob to Frank (green and pink tokens on the balance sheet) is both an asset and a liability for the two of them as a group, so they cancel each other out on this group balance sheet. So between them, they can consume 42 days’ food and 42 days’ firewood without having to produce anything.

Looking at the balance sheet, you can see that their combined savings are the same as their combined raw net worth.

Now let’s look at the individuals’ balance sheets. First, Bob.

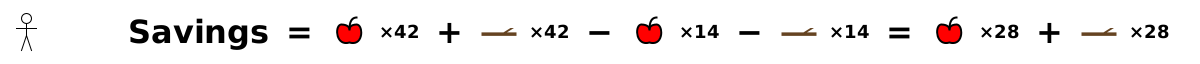

Bob has 42 days’ food and 42 days’ firewood. But he can’t count all of them as his savings because he owes some of them to Frank: if Frank comes along with his tally stick, Bob has to hand over the food and/or firewood. That could be awkward if he’d consumed them himself. So how much does Bob have of his own savings? It’s the 42 days’ food + 42 days’ firewood - 14 days’ food - 14 days’ firewood, which simplifies to 28 days’ food + 28 days’ firewood.

Oh look - his savings are his raw net worth!

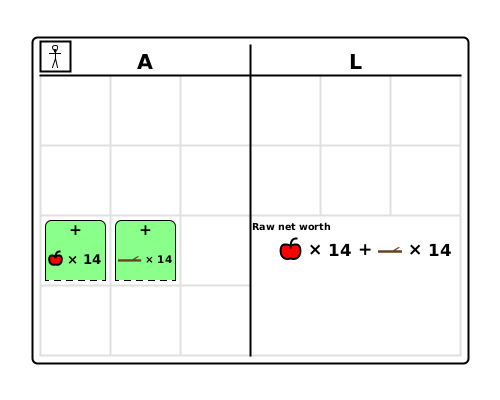

And here’s Frank’s balance sheet.

Frank doesn’t have any food or firewood stored, but he has debt assets for them. If he goes to Bob to demand payment, Bob has to hand over the food and/or firewood. Frank is owed 14 days’ food and 14 days’ firewood by Bob. So Frank can consume up to 14 days’ food and firewood without having to produce anything. So how much does Frank have in savings? It’s 14 days’ food + 14 days’ firewood.

Oh look - his savings are his raw net worth! What a surprise!

Savings = raw net worth.

What about insolvency?

There’s only one more thing to consider. What if Bob doesn’t have enough food and/or fuel in his store to pay the debt he owes to Frank? This could happen in various ways. One is if Bob stops producing for 30 days, and so consumes more than his own 28 days’ savings. Another possibility is that some wild animal gets into Bob’s cave and eats 30 days’ food and chews 30 days’ firewood to bits. Either way, there’s only 12 days’ food and fuel left, but Bob owes 14 days’ food and fuel to Frank.

Find out what this does to savings in the next article…

Summary

As long as a person’s debtors are solvent (have enough assets to pay all their liabilities), that person’s savings is their raw net worth, whether their assets are tangible (things they own) or debts (things owed to them). It’s what they can use and consume without having to produce anything.

Someone’s raw net worth (RNW) is what they own plus what they’re owed minus what they owe. It is a “heterogeneous” sum/difference, which just means that things of different types are added and subtracted, not monetary “values” which have been assigned to them.

Sorry for the horrible scenario, but have you read Robinson Crusoe?

For people who like asking awkward questions, they found a sharp stone on the beach and some small sticks other than the firewood. And yes, technically those are assets, but let’s not worry about that. It makes no difference to understanding savings.

When I write 28 days’ food, I mean 28 person-days’ food, meaning enough food for one person for 28 days. Same for firewood. I decided not to write “person-days” in the article each time, because it’s ugly and makes it hard to read.