The UK Exchequer (10)

Illustrating the Berkeley, Tye and Wilson study — Government Spending (6)

This is the tenth in a series of articles illustrating the Berkeley, Tye and Wilson (BTW) study “An Accounting Model of the UK Exchequer”.

It’s a short article based on section [5.5], which describes the “Ways and Means (W&M) Account”. It’s basically where the government has a long-term overdraft facility with the Bank of England (BoE), for times when it’s spent more than the money coming in from tax payments and borrowing.

This section of the BTW study shows that the BoE is actually composed of two legal entities: the Issue Department, and the Banking Department.

As always, I’ll be cross-referencing the BTW study by putting section numbers in square brackets.

Basics of Exchequer Spending (ctd) [5]

The Ways and Means Account [5.5]

In the last article, the government spent £5 without receiving any money from tax revenue or borrowing. It did this by drawing on an overdraft facility at the BoE. Following the end-of-day sweep, the £5 overdraft was in the National Loans Fund’s (NLF) account at the BoE.

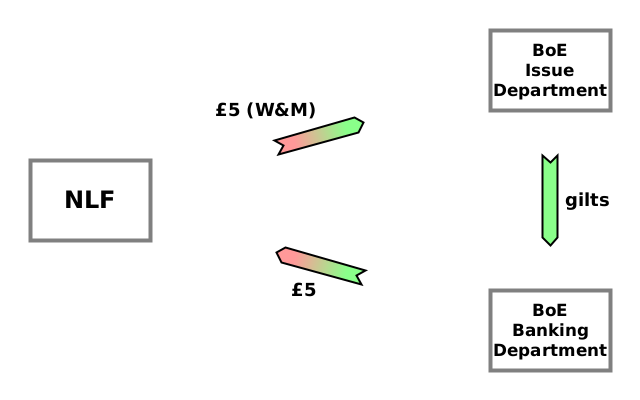

This section shows a transaction in which the overdraft is transferred to the Ways and Means (W&M) account, which is actually held with the Issue Department of the BoE — the part which issues banknotes. (Every interaction with the BoE which we’ve seen in earlier articles has been with the Banking Department). This involves a set of transfers around a loop between the NLF, the Issue Department and the Banking Department.

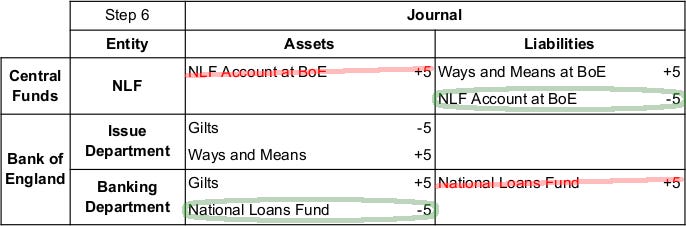

As we’ve seen before, there are several inconsistencies in the BTW study between the balance sheets and the journals. Here, the journal shows an increase in the assets of the NLF’s account, but the balance sheet shows a decrease in its liabilities. In this article, I’ll be following what the balance sheets say: the journal below shows the changes made to match the balance sheets.

There are 3 actions:

The NLF owes a new £5 debt to the Issue Department (in the Ways and Means account).

The Issue Department transfers some gilts1 to the Banking Department.

The Banking Department writes off the NLF’s £5 debt to it.

The journal shows £5 “worth” of gilts being transferred from the Issue Department to the Banking Department. That doesn’t necessarily mean a government IOU for £5, because the prices of gilts can rise and fall, for reasons which I won’t go into here. Since the “current market price” is not what RNW represents, I’ll simply show this as “gilts” without specifying exactly what face value of gilts is transferred. The transfer of gilts is still zero-sum: the Banking Department’s RNW↑ by exactly as much as the Issue Department’s RNW↓.

The NLF had a short-term £5 overdraft with the Banking Department (i.e. it owed the Banking Department £5), but now has a long-term £5 overdraft (or a £5 increase in it) with the Issue Department. The Issue Department, with its new debt asset, compensates the Banking Department for having to write off the original debt by transferring some gilts to it.2

The W&M Account in practice

This is my own observation, not part of the BTW study, but from my reading of the NLF accounts for 2023-24, the “Other Debt” owed by the NLF to the Issue Department (see P44) was £371m. It’s not clear whether this is only the W&M account, but it appears that the W&M account is included; if so, £371m is the most it could be. And compared to annual government spending, it’s a tiny fraction: < 0.1%.

Summary

The Ways and Means (W&M) account is a place where any debts owed by the government to the Bank of England (BoE) are accumulated when there isn’t enough income from taxes or private sector borrowing to cover its spending. By moving the balance from the main National Loans Fund (NLF) account to this long-term overdraft account, the main account can be kept clear of accumulated historical debts.

While in theory an unlimited overdraft balance could be kept in the W&M account, it seems that, in practice, the government avoids using it for any substantial sums.

Gilts are UK government bonds. Essentially an IOU for the original amount lent plus a set of IOUs for interest payments.

In fact, these gilts are also liabilities of the NLF, so the Banking Department has just swapped one NLF IOU for another. And so has the Issue Department.